For Clients

For Service Providers

Malaysia

Zoar Limited

HKEx Algo Trading Application

Requirements

A local HK base equities trading firm wanted to build an Algorithmic Trading application to trade on Hong Kong Stock Exchange (HKEX) directly. The firm has sufficient funds and licenses to setup the connection.

Work involve building a certified BSS – by going through full-scale testing from HKEX.

Building algorithmic trading connecting to the BSS.

Latency optimization.

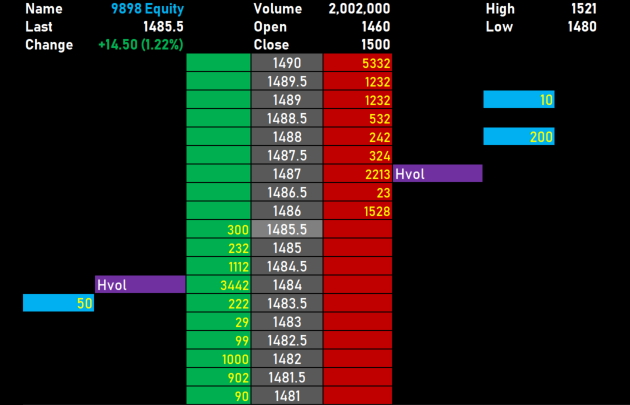

Simple UI to allow emergency STOP “bulk cancel orders”, monitor order/trades and adjust algorithm parameters.

Analysis

Leveraging our many years working in investment banks with electronic trading, connectivity knowledge and dealings with global exchanges, we should be fine to take on the project.

Challenges

HKEX Data connections has a cost per month, even for testing. Need good project management to Go-Live as soon as possible when HKEX starts to charging.

The firm owners are traders and will provide algorithms. Need to bridge such algorithms into technical codes and see feasibility.

Compliance/Monitor module – Allow fail-safe shutdown operations (in the case of trading errors) and reliable monitoring for the trading application.

Reflections

A great experience on working out a trading system from 0 to 1. The technical and coding part for the project is simple. However, work liaise with different parties such as HKEX IT department, testing environment arrangement, infrastructure setup from other vendors took a lot of time and effort.

A local HK base equities trading firm wanted to build an Algorithmic Trading application to trade on Hong Kong Stock Exchange (HKEX) directly. The firm has sufficient funds and licenses to setup the connection.

Work involve building a certified BSS – by going through full-scale testing from HKEX.

Building algorithmic trading connecting to the BSS.

Latency optimization.

Simple UI to allow emergency STOP “bulk cancel orders”, monitor order/trades and adjust algorithm parameters.

Analysis

Leveraging our many years working in investment banks with electronic trading, connectivity knowledge and dealings with global exchanges, we should be fine to take on the project.

Challenges

HKEX Data connections has a cost per month, even for testing. Need good project management to Go-Live as soon as possible when HKEX starts to charging.

The firm owners are traders and will provide algorithms. Need to bridge such algorithms into technical codes and see feasibility.

Compliance/Monitor module – Allow fail-safe shutdown operations (in the case of trading errors) and reliable monitoring for the trading application.

Reflections

A great experience on working out a trading system from 0 to 1. The technical and coding part for the project is simple. However, work liaise with different parties such as HKEX IT department, testing environment arrangement, infrastructure setup from other vendors took a lot of time and effort.

INDUSTRY: Financial Services

INDUSTRY: Financial Services

CLIENT SIZE: Enterprise

CLIENT SIZE: Enterprise